Material Competence is Becoming Increasingly Decisive for Competition

In an interview with packaging-360.com, Christoph Kopp, principal investigator of the newly published study „The European Packaging Industry 2025“ by the management consultancy Horváth, talks about the challenges for packaging companies.

Which result of the study surprised you the most?

Christoph Kopp: I’ve been working in the industry for many years, with different customers, so there were no big surprises for me. But two aspects stood out clearly: Sustainability and digitalization are still the big topics and are becoming even weightier. A sustainable product is recognizable as such by its packaging. Therefore, product innovations in the packaging industry are primarily driven by sustainability. In addition, the study revealed that the state of digitization among the companies in the packaging industry is very, very different. The topic ranges from process automation to the question of how I can digitize sales activities for the benefit of both parties – the customer’s and the manufacturer’s. There are also differences between companies in the value-added steps: large and new paper machines are highly digital, while small and old presses are still more analog.

Which insights have you gained into the market environment?

Kopp: Fundamentally, the packaging industry is characterized by constant growth. There are no major ups and downs. It showed this particulary during the pandemic-related crisis. The packaging industry was more stable than most other industries. That is why it is very popular with investors.

At the same time, we are seeing increasing commoditization of products and corresponding pressure on margins in many segments. This forces operational excellence in all areas and a corresponding strategic orientation in order to avoid being completely trapped by rising costs.

If we look at the current market, we see almost unprecedented price increases for raw materials, especially for plastics. The crux will be whether the packaging industry can pass on the prices to its customers. Plastic packaging manufacturers are being squeezed between large suppliers from the chemical industry and large customers from the consumer goods industry. This will weigh on the business figures for some packaging groups in the second half of the year.

The sustainability megatrend has been around for several years. What more can the packaging industry do to change?

Kopp: The willingness to buy sustainable products has increased and become more serious – both among consumers and among the major consumer goods and retail groups. Around 75 percent of consumers, a study of ours has shown, pay attention to the environmental friendliness of everyday products. In the past, consumers were not willing to pay more for a sustainable product, nor were consumer goods and retail groups for more sustainable packaging. That has changed to some extent.

With packaging ending up in the trash rather quickly, Circular Economy is an issue that challenges the industry. With paper, there are good and established recycling streams, and consumers are aware of this. With plastics, the situation is still different. In the medium and long term, the question is where sufficient recycled granulate for plastic packaging will come from. The industry is already taking action against this backdrop: there are chemical companies that are getting involved in recycling companies, and one or two packaging companies are also thinking about it. In this context, design for recycling is also becoming increasingly important.

Another important sustainability aspect for consumers is the biodegradability of packaging. Here, images of ocean passages and beaches covered in plastic waste have become imprinted in people’s minds. This is another reason why the clear trend is away from plastic and towards paper.

At the same time, consumers often forget that packaging has a protective function that must also be taken into account in during sustainability considerations. A higher spoilage rate of products due to supposedly more sustainable packaging can also be counterproductive in the overall view.

Does sustainable packaging become even more sustainable?

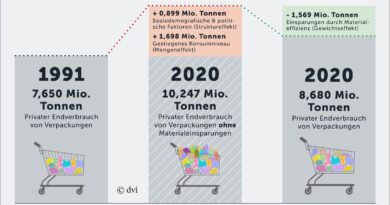

Kopp: This is exactly what we are currently seeing. It’s about material efficiency and reducing the use of materials as well as keeping materials in the cycle for as long as possible, i.e. using recycled raw materials and product design that enables recycling. For plastic packaging, the latter means above all the use of monomaterials that can be easily recycled.

As a result, the material competence of packaging companies is also becoming increasingly important and decisive for the competition. In the future, the competition will therefore be decided to an even greater extent by material competence.

Companies must clarify for themselves how they can develop these materials themselves, whether and how they work with suppliers or with research institutes. It can’t hurt to have the courage to look to external partners for material development if you want to move forward quickly and effectively. Regarding this, the packaging industry can learn from other industries that have been implementing ecological for some time.

The small-scale packaging industry will consolidate, according to the study. What does that mean for whom? Can you be more specific?

Growth can be seen among existing players in the industry. The big players are regularly buying up smaller companies to penetrate new markets or technologies and generate growth. In short, the big players are getting bigger and the smaller ones are getting fewer. We can also observe strong vertical integration in the industry, which is driving consolidation.

What role will e-commerce play?

Kopp: E-commerce is a smaller segment, but it will grow consistently by 10 to 15 percent over the next few years. Since the Corona-related crisis, everyone has learned how to shop online. This will continue to have an impact, particulary on the paper packaging industry, but to some extent also on that of flexible packaging.

Christmas is just around the corner. What will change about seasonal sales in the future – in terms of packaging?

Kopp: Seasonal adjustment is an issue with consumer goods. In general, batch sizes have tended to get smaller due to seasonal specials and shorter-term adjustments to design. That’s not going to continue. E-commerce will play a stronger role again at Christmas. Also due to the current pandemic situation, e-commerce is still popular. In general, the sustainability trend will also have an impact on presentations and packaging in the Christmas business. Opulent packaging is no longer so favored, and instead sustainable packaging in plain brown paper is becoming increasingly so.

by Anna Ntemiris

A report on the study can be found here.